mvba makes the local news.

Presenting our collection efforts on behalf of the City of Marshall to the City Council meeting

When the City Council of Marshall met late last year, reporter Jessica Harker from the Marshall News Messenger was there to take notes on how the City benefits from mvba’s services. Her resulting article ran on December 22, 2023 and you can find it here. In it, she detailed the City’s handling of delinquent tax, fines and fees (F&F) collections using this firm as their third-party vendor. City Manager Terrell Smith introduced to meeting attendees both Liz Vaughn, Shareholder of the Longview office, and John Morris representing our F&F team. This joint presentation was their first for the city and will continue annually.

First up, the successful collection of delinquent F&F

John shared with the City that mvba has handled 13,248 cases on its behalf in the last seven years. Forty-six-and-a-half percent (46.58%) of those cases have been collected and/or otherwise resolved through our efforts, resulting in over $1 million ($1,017,256.23) paid to the City, which would have been lost, if they hadn’t been pursued. Another $2-plus million ($2,352,627.23) were otherwise resolved through these efforts, representing 6,171 cases canceled, closed, or struck from the record. This means the Municipal Court no longer has to track these cases.

John also shared a full breakdown of the disposition, or status, of cases. That is, whether they had been paid in full or if partial payment had been made, as well as cases that were canceled by the Municipal Court or otherwise resolved.

Lastly, John showed the City Council a quarterly breakdown of the communications mvba conducted on behalf of the City to resolve each case.

Delinquent property tax collections are also going well

After John completed his presentation and answered questions, Liz shared about the goings on of the delinquent tax side of collections.

mvba does not have an individual contract with the City, rather we service it through our partnership with Harrison County and Harrison CAD. As Harker writes, the firm has “a wide range of ways [we] are working to collect on the city’s around $880 thousand outstanding delinquent property taxes.”

Liz explained how the property taxation process and calendar in Texas. Property value is assessed on January 1. On October 1, property tax statements are mailed by the taxing entity to all property owners. On February 1 of the following year, the previous year’s property taxes become delinquent. That is, property owners have all of the first month of the next year to pay property taxes. The taxing entity turns over the delinquent tax cases to mvba for further collection efforts on July 1, five months after they became delinquent. We work all cases until they’re paid, canceled, closed or otherwise resolved,regardless of how long they’ve been outstanding.

Liz also shared a full breakdown of how many delinquent tax cases are in each stage of the process, including, but not limited to, number of cases currently involved in litigation or that have already reached a judgment, cases still being researched, cases in bankruptcy, cases that are uncollectible or have an unknown address, as well as tax-deferrals for over-65 and disability.

The total delinquent tax collections for any given year will be over 100% of the adjusted tax levy, owing to statutorily allowed penalty and interest assignments for late ad valorem taxes.

Also included in Liz’s presentation were the total number of notices and personal property notices mailed, as well as the total number of properties in district court suits, total for which judgments had been taken, and total for which tax warrants had been issued. Lastly, she gave a detailed discussion of properties subject to tax sale procedures and bankruptcy proceedings.

We are pleased to be able to serve our clients with best-in-class delinquent collections for both fines and fees and property taxes. Our efforts result in more money returning to our client’s communities for their use in better serving their public.

If your City or Municipality would like to discuss how mvba can serve your delinquent collection needs, please don’t hesitate to call us at (512) 323-3200.

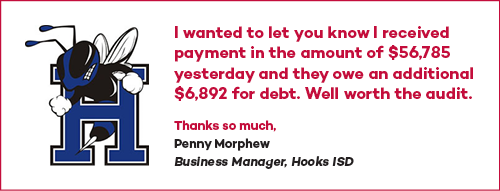

Our Taxable Value Audit (TVA) team cannot forecast whether any district will be eligible for financial relief in a given school year as it varies with changes to the school district’s property tax roll.

Our Taxable Value Audit (TVA) team cannot forecast whether any district will be eligible for financial relief in a given school year as it varies with changes to the school district’s property tax roll.