Property Tax

The most effective & comprehensive program in the Lone Star State

When it comes to collecting unpaid property taxes, we have represented governments, districts, municipalities and other taxing entities for over a half century. Our clients have come to rely on the mvba standard of care.

Local governments trust us to communicate with their public.

We treat everyone with the same impeccable service. We foster positive public relations with your taxpayers through fair, thoughtful and compassionate treatment. We make it easy on your property owners to pay their late fees by offering multiple payment options, including installment agreements, if needed and in accordance with the taxing unit.

People don’t pay bills they don’t know they have.

Very often, we find that property owners have become delinquent in their payment of annual taxes because they never received the notice, either because they moved or a had a death in the family. Our team takes pains to confirm and update all property owner contact information so that defendants can be made aware of their outstanding balance. Usually, that’s all it takes.

We go further for Texas.

We’re not here for everyone. Our expert teams only serve Texas clients and only governmental entities, like county courts and municipal water districts, appraisal and school districts, fire and emergency services.

The mvba Advantage

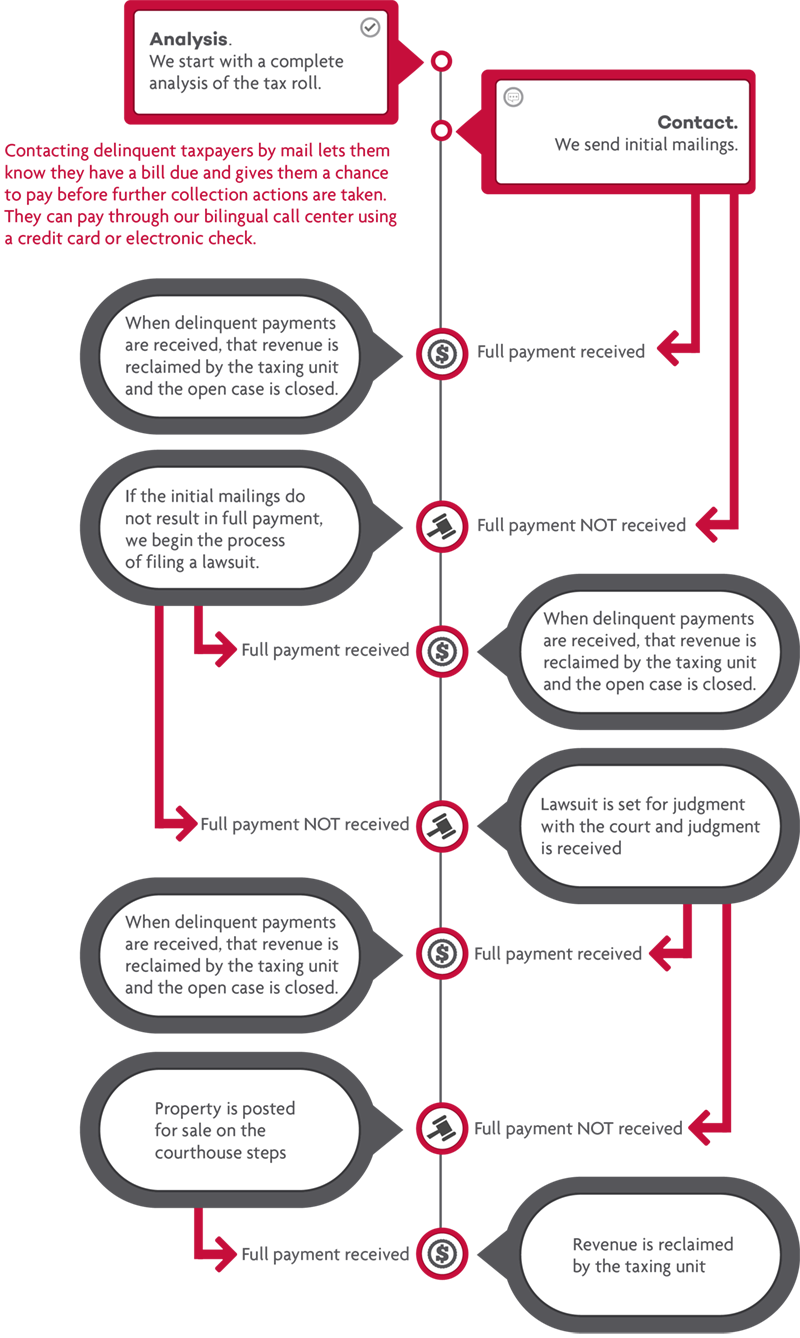

Our process for collecting your delinquent property taxes

Upon receipt of the client’s tax roll, we perform a complete analysis to confirm and update contact information and to prioritize our communications for the greatest return. We meet with our client’s staff to determine the best workflows and defendant notifications processes. We offer the full-suite of communications services, including online payment portals, bilingual written mailings, inbound and outbound calling campaigns, and state-of-the-art dialing software. We have best practices in place for every contingency and we tailor them, as necessary, for each client’s situation.

We always act with the utmost integrity and full compliance with the Fair Debt Collection Practices Act (FDCPA) and all other applicable federal, state and local laws.